Tag Archives: WIMort

Mortgage Rates Slowly Inching Up

Mortgage Rates Slowly Inching Up As we enter the fourth quarter of 2021, mortgage rates are trending slightly higher than the historic lows we have been experiencing. Thirty-year fixed mortgage rates are ranging between 2.875–3.125% — still offering a great …

Read More

Company Happenings

Shorewest is proud of its newest class of Ninja Graduates In an effort to ensure our team provides the best results and overall experience for our clients, Shorewest was the first real estate company in Wisconsin to bring in the …

Read More

A Wisconsin Mortgage Corporation Loan Officer is the Whole Package

A Wisconsin Mortgage Loan Officer is many things and all of them are of a benefit to you as a client. Loan Officers are: Convenient. Loan Officers are available to fit your schedule — days, evenings and weekends. Innovative. They …

Read More

The Truth About Federal VA Financing

Sellers can be assured that buyers eligible for Federal VA financing are great buyers ready to go to closing. Veterans have earned benefits that can greatly assist them when financing a home purchase. Qualifying for the loan is no different …

Read More

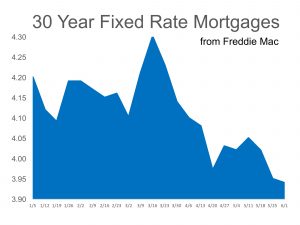

Where are Mortgage Rates Going?

Home buyers have enjoyed historically low mortgage rates and an improving economy in the past few years. In this type of financial climate, the question of would mortgage rates increase became how much would rates increase in 2017? When the …

Read More

Why Now is the Best Time to Buy a Home!

Many times, the holidays are seen as a slow time in real estate. However if you are thinking about buying a home, now is actually the best time! Mortgage rates have been hovering around 3.5% since June, and in November …

Read More

Home Equity is a Good Thing to Have!

Equity can be defined as the difference between the value of the assets and the cost of the debt owed. For example if someone owns a house worth $100,000 and owe $80,000 on the home, that home represents $20,000 or …

Read More

What Can You Expect for Closing Costs?

First of all what are closing costs? Closing costs are the fees paid to third parties that helped facilitate the sale of the home. You can estimate that the closing costs will typically total two to seven percent of the …

Read More

Sign in

Sign in