Tag Archives: first time home buyer

Millennials, Did You Know This About Down Payments?

Housing experts have done much research into why we don’t have more first-time home buyers entering the market. In looking at this issue, recent surveys of Millennials (the largest first-time home buyer pool in history) uncovered that 60% of these buyers believe …

Read More

June is National Homeowners Month!

Happy National Homeowners Month! It is time to celebrate and promote the American Dream of owning a home. Using a REALTOR® makes it more affordable, attainable and sustainable for anyone looking to start on the homeownership journey. The dream of …

Read More

Resource Video: Buyer Edition

Ways to Reduce Closing Costs Every mortgage loan incurs fees known as “closing costs” or “settlement fees.” This informational video goes over the different types of closing costs. Your Shorewest, REALTOR® is here to answer any questions you may have …

Read More

Resource Video: Buyer Edition

How Much Money is Required to Buy a House? The amount of money you’ll need up front to buy a house depends on a number of factors, but, in general, you’ll need to come up with enough money to cover …

Read More

Resource Video: Buyer Edition

Reasons You Should Buy a Home There are many reasons why you should consider buying a home to experience the joys of homeownership. This informational video provides financial and emotional reasons to purchase a home. Your Shorewest, REALTOR® is available …

Read More

Resource Video: Buyer Edition

Why is Location Important When Buying a Home? You’ve probably heard the old real estate saying, “Location, location, location.” When you buy a home in a good location, it usually becomes a solid, long term investment. That’s why a home’s …

Read More

Resource Video: Buyer Edition

Things to Do Before House Hunting Before you start house hunting, make sure you are ready and qualified to start your search. Home buying can be an emotional process, that’s why it’s a good idea to have your Shorewest, REALTOR® …

Read More

Resource Video: Buyer and Seller Edition

Who is Responsible for Making Repairs Called for in a Home Inspection? A home inspection helps a buyer discover any issues with a home before the closing. The buyer is responsible for selecting and paying the home inspector, but if …

Read More

Calling All Sellers!

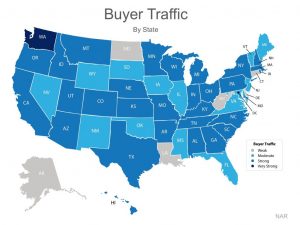

Why does the market sway between a buyer’s market and a seller’s market? The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS® (NAR) surveys “over 50,000 real estate …

Read More

Want to Buy or Sell a Home? Now is the Time!

2016 was the year of low mortgage rate and also low inventory. The average for the 30-year fixed-rate mortgage was 3.65% which is the lowest annual average ever recorded by Freddie Mac going back to 1971. Since then mortgage rates …

Read More

Sign in

Sign in